As of 1 January 2025, Kazakhstan has brought into force a new Budget Code along with an accompanying law, completing a large-scale reform of budgetary and investment legislation. A substantial set of amendments affects the field of public–private partnerships (PPPs), which the state views as one of the key instruments for delivering infrastructure and social projects.

A Systemic Approach to Public Finance

One of the central objectives of the new Budget Code is to align tax and budget policy with monetary and fiscal policy. For the first time at the legislative level, the concept of public finance has been formally defined as a system of relations encompassing the republican and local budgets, the National Fund of the Republic of Kazakhstan, the quasi-public sector, and extra-budgetary funds.

The Code is aimed at improving the quality of budget planning, as well as enhancing transparency and accountability across public authorities.

Greater Autonomy and Accountability of Public Authorities

On a pilot basis, a block budgeting model is being introduced in two central and two local executive bodies. This model allows for the reallocation of up to 15% of funds within budget programs. A key innovation is the ability to carry over unspent funds into January of the following year, ensuring continuity of financing.

At the same time, the role of Parliament has been strengthened. Limits on government obligations – Including obligations arising from PPP projects – are now subject to approval through the law on the republican budget.

Completion of PPP Legislative Reform

The accompanying law adopted simultaneously with the Budget Code represents the logical conclusion of the reform of PPP legislation. It abolishes the separate regulatory framework for concessions, integrating concession arrangements into the unified legislation on public–private partnerships. This approach is intended to improve project quality, reduce legal risks, and simplify the regulatory framework.

The majority of legislative amendments entered into force on 1 January 2025. An exception applies to certain provisions, notably the accreditation of advisory services in the PPP sector, which will take effect from 1 January 2026.

Importantly, the new rules do not apply retroactively to projects initiated prior to 2025. Previously concluded PPP and concession agreements continue to be implemented under their existing terms. Where agreements have not yet been signed, the relevant projects proceed in accordance with the approved tender documentation or the corresponding investment proposal.

| Project Implementation Stage | Applicable Legal Framework | Comments | |

| 1. | Initiation stage a) an economic opinion has been issued for a Government Investment Project (GIP); or b) a conclusion of the authorized body has been issued confirming the feasibility of implementing the project based on a private initiative; or any subsequent stage following (a) or (b), including cases where the tender documentation, draft agreement, or business plan has been developed or approved, or where a tender has been announced, etc. | The provisions of the Law on Public–Private Partnership apply, without taking into account the accompanying law. Where tender documentation has been approved, the provisions of the tender documentation apply. Where no tender documentation has been approved, the current PPP Rules apply (effective as of 23 August 2025). | At the same time, the accompanying law does not introduce any critical amendments in the PPP sphere that would affect project structuring or the selection of a private partner. The amendments are mainly clarifying and improving in nature and may be applied to new projects, including those already initiated, without any adverse impact. The PPP Rules were reapproved in connection with the adoption of the new Budget Code and do not contain any contradictions with the previous version of the Law on Public–Private Partnership. |

| 2. | Tender announced, private partner not selected | PPP Law (previous version); approved tender documentation | If issues are not regulated by tender documentation, the previous version of the PPP Law applies. |

| 3. | PPP or concession agreement concluded | PPP / Concession Agreement | Contracts continue to be implemented under agreed terms; alignment with new amendments is not required. |

Why the Development and Adoption of the New Budget Code Are Inextricably Linked to PPP Regulation

Public private partnership (PPP) is one of the forms of government investment projects. In other words, PPP serves as an instrument for the creation and development of public infrastructure and for addressing the socio-economic challenges faced by the state.

Why the Budget Code and PPP Are Closely Interconnected

PPP is one of several forms of government investment projects, alongside budgetary investments, turnkey construction, budget lending, and projects implemented by quasi-public sector entities with state guarantees.

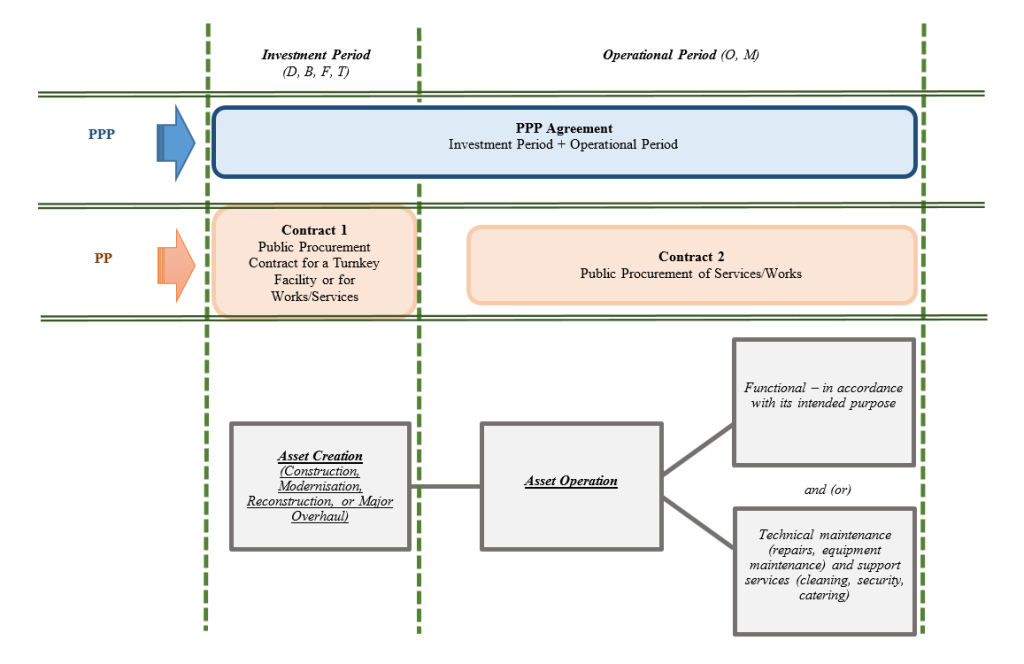

In international practice, PPPs are often viewed as a type of public procurement. However, in Kazakhstan, PPPs, public procurement, and turnkey construction are clearly separated from a legal standpoint – primarily due to differences in the allocation of risks.

PPP vs. Public Procurement: The Key Distinction

Projects implemented through public procurement generally assume that the state:

- finances the creation of the asset,

- takes ownership of the asset, and

- bears all risks related to operation, suitability, and achievement of intended objectives.

PPP projects, by contrast, are based on the transfer of a significant portion of investment and operational risks to the private partner. The recovery of investments and the investor’s return are possible only if the facility is not merely constructed, but also efficiently operated and delivers the planned performance outcomes.

This is precisely why PPP projects may appear more expensive at first glance: their cost reflects the time value of money and the price of risks transferred to the private sector. In the case of public procurement, these same risks ultimately fall on the budget, albeit without being explicitly quantified or priced.

Essential Characteristics of Public-Private Partnerships

Legislation establishes a number of mandatory characteristics of public-private partnerships (PPP’s), including:

- the long-term nature of projects (typically from 5 to 30 years);

- the mandatory conclusion of a PPP agreement containing defined essential terms;

- private financing and the private partner’s responsibility for achieving financial close;

- the pooling of resources from the public and private sectors;

- the inclusion of both investment and operational phases within a single contract; and

- active involvement of the state in monitoring and facilitating project implementation.

PPP in the System of Public Investment

The adoption of the new Budget Code and the accompanying amendments in the PPP sphere has resulted in a more coherent and integrated system of public investment. PPP has been firmly established as one of the equal instruments for implementing government investment projects, applied in cases where the priority lies not only in the construction of an asset, but also in its long-term operational efficiency.

PPP projects, like other forms of public investment, are now tightly embedded in the public planning framework, with a strong emphasis on performance outcomes, risk management, and the sustainability of budgetary commitments.